The frame game: an Italian startup is focused on transforming the fashion eyewear business

Roberto Vedovotto likes to think of Kering Eyewear as a startup, a lean, mean entrepreneurial upstart bringing innovation and disruption to a business dominated by a few too-powerful players. But if this is a startup, it’s an unusually smart one. No Ikea trestle-tables and sticker-plastered laptops here, none of the scruffy urgency of Silicon Valley or Shoreditch.

Vedovotto’s startup is backed – to what percentage has not been disclosed – by luxury goods giant Kering Group (formerly known as Gucci Group) with a 20-strong brand stable that includes Gucci, Saint Laurent, Bottega Veneta, Alexander McQueen and Stella McCartney. And its new inside-but-outside eyewear division has suitably glamorous quarters in Villa Zaguri, a smartly restored Renaissance pile just outside Padua.

Less than half an hour’s drive west of Venice, this is the heartland of Italy’s high-end, high-skill manufacturing base. And the local skill set includes eyewear. Safilo, the world’s second largest eyewear company after Luxottica – and the company that, until recently, made eyewear under licence for a number of Kering brands – is based here.

Vedovotto, a former Safilo CEO, formed Kering Eyewear in September 2014 with the clear intention of challenging the established order and pushing a new business model for the industry. A report by Exane BNP Paribas called the launch an ‘eyewear revolution’.

The luxury goods industry has long licensed out its fragrance, eyewear and beauty businesses, even though these are the real money-spinners. They are also ‘entry products’, the point where younger customers especially get their first ‘experience’ of a brand and hopefully develop a taste for more.

This arrangement can seem counter-intuitive, particularly when it comes to eyewear. The premium fashion segment of the eyewear market could now be worth as much as $12.5bn. It is also an area with massive growth potential. Licensing arrangements then mean not only a loss of creative control, but also a loss of pure profit. The brands pull in huge royalty payments, but they are only a percentage of the possible returns. At the time of the launch of Kering Eyewear, Vedovotto said the Kering Group’s eyewear business was worth €350m, generating royalties of €50m.

However, while the luxury goods giants have been buying back licences in other categories, most have considered producing and distributing eyewear too far out of their comfort zone. ‘Eyewear is a very technical product,’ says Vedovotto. ‘It also has a completely distinct distribution model.’ Supplying thousands of independent opticians around the world is definitely not part of the luxury goods group's skill set. Still, with a number of Kering licences coming up for renewal, Vedovotto and Kering Group CEO François-Henri Pinault thought it was time to take a risk. The rewards were simply too great to ignore.

Kering Eyewear is based around what Vedovotto calls a mixed-model. Essentially, it has taken back control of design and product development, working with the creative teams of each brand, marketing and brand management, logistics and distribution. The only link of the ‘value chain’ that it hasn’t ‘internalised’ is manufacturing. But instead of being locked into deals with the licensed manufacturers, it is now free to deal with a whole range of specialist makers. This new model means that Kering Eyewear can ‘create products that are fully aligned with the brands’ DNA’, as Vedovotto puts it. It will also look at upping quality without ramping up prices and undermining the ranges’ entry product promise.

The man charged with making all this happen is Kering Eyewear’s creative director Massimo Zuccarelli, also formerly of Safilo. He heads up a 25-strong team in Padua, which managed to put out nine eyewear collections less than a year after Kering Eyewear was launched (and while their renaissance villa was still being decorated and without Wi-Fi. ‘It was kind of a nightmare, but the energy was incredible,’ says Zuccarelli).

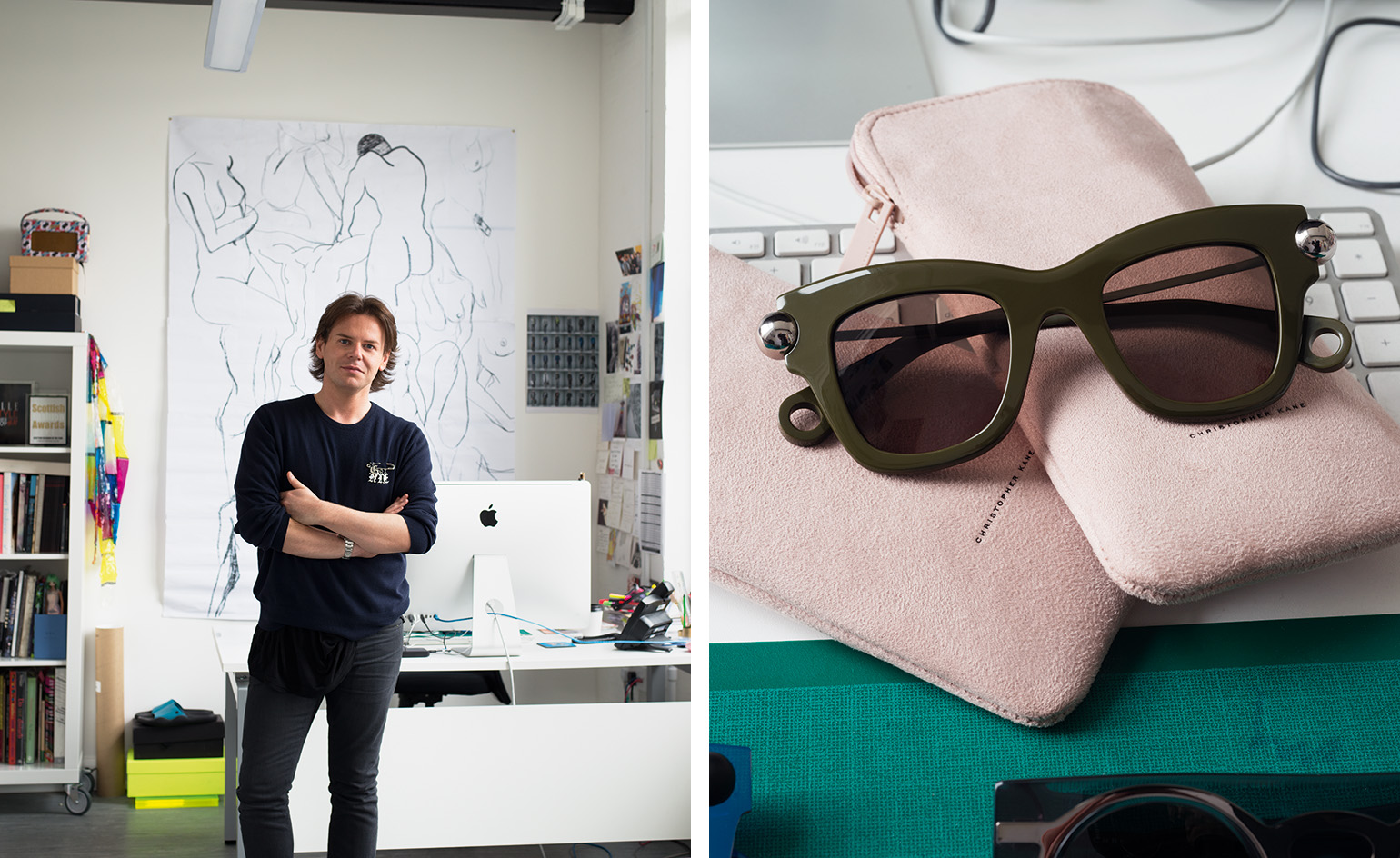

These launch ranges included a debut eyewear collection for the Milan-based jewellery brand Pomellato. Since then, collections by Tomas Maier and Christopher Kane have also been added. The creative relationship with the brands varies, says Zuccarelli: ‘Some teams come up with a very full briefing with shapes, designs, technical drawings and materials. Others present more of a vision. We don’t have a rule. We have the right support for anyone.’ Kane seems to support that. ‘I showed them my crappy sketches and they made them a reality,’ he says, only half-joking.

What seems to most excite Zuccarelli, though, is the range of manufacturers – and thus finishes, materials and effects – he can now show the brands. He seems particularly excited about the Japanese makers that Kering is now working with, even if costs mean he has to use them sparingly. ‘There are a lot of niche eyewear brands in Japan and we are the first people to use those makers for other brands. The finishing of the Japanese makers is different because they are so obsessed with vintage; the galvanic treatment, the polishing, the raw materials they use, the acetates, it really recalls vintage eyewear.’

The group now works with over 30 different suppliers. But, as Vedovotto says, this is not just fancy and indulgence on their part. This wealth of materials and finishes means they can produce ranges with distinct looks and identities. With 11 brands already up and running, Gucci on the way and long term plans to launch more, cannibalisation of sales is an obvious risk. ‘I don’t want to do the same thing as everyone else,’ says Kane. ‘They are constantly bringing these new techniques and technologies to the table so everyone has options and can do something different.’

Inevitably, perhaps, it is with the debut eyewear ranges that Zuccarelli has had the most freedom and pure fun. For Tomas Maier, he has developed a small range of contemporary aviators with flat lenses and other reworkings of American classics.

With Pomellato, the job was to create a range that somehow built on the brand identity without doing the obvious. ‘We wanted to do something different from just putting jewels or stones on the glasses,’ says Zuccarelli. ‘The idea was to replicate the feeling and the craftsmanship. And it wasn’t easy. We worked on the acetates to replicate the colour of the stones and the polishing and the finishing to replicate the feeling of the stones. The result is incredible.’ Sometimes these vivid acetates in different colours are melded in one frame, to startling effect. As Pomellato creative director Vincenzo Castaldo says, the Kering Eyewear team has also managed to do something smart and playful with a key part of the Pomellato design language. ‘Traditionally, a griffe was just a functional element to keep a stone in place,’ says Castaldo. ‘But in the early 1990s, Pomellato transformed it into something decorative in its own right, part of the overall aesthetics.’ The griffe reappears on the eyewear collection, transformed into a hinge.

With other brands there were different challenges. For Stella McCartney, the team worked with acetate specialists Mazzuchelli to develop a sustainable bio-acetate. And Zuccarelli is determined to use sustainable materials across all ranges within a few years. Material development is key, he says, and he is keen on using new and unique materials, when economies of scale allow. Zuccarelli is more than conscious that the venture will fail if he can’t bring all this novelty and innovation in under a certain price, or produce ranges with a ‘price architecture' that fits the brand and the market.

‘The prototypes we show the brands are exactly as they will be in the final production,’ he says. ‘Every problem, every detail has been worked out. We understand how it can be industrialised and how much it will cost. And for every prototype, there are alternatives, fully costed in the same way. It is very difficult because there is this balance between creativity and industrial design. And we are in the middle. We want to create proper collections based on market needs.’

There are still those, though, who think that however in tune they are with market needs, Kering Eyewear will struggle, at least at first. Startup costs have been significant. A renaissance villa full of the right kind of talent doesn’t come cheap. And when Kering Eyewear was launched, its prize licence, Gucci, still had four years to run. It had to pay Safilo €90m to terminate the licence two years early (Safilo will continue to produce the collection, at least for the next four years). Gucci will become Kering Eyewear property at the end of 2016, and the success of the first Gucci collection is essential.

What Luxottica and Safilo offered, apart from manufacturing know-how, is a huge distribution network and sales force. An Exane BNP Paribas’ report on the launch of Kering Eyewear identified getting to grips with distribution as probably its biggest challenge. And two years on, Luca Solca, head of luxury goods at Exane BNP Paribas, remains unconvinced that the new operation will deliver better returns than the previous licensing deals. ‘Kering Eyewear is an interesting experiment, but it looks like an over-ambitious business proposition to me.’

Vedovotto thinks he can prove them wrong. Distribution will be handled by a dedicated sales team, rather than agents on commission, which is how the licence holders handle it. And though the opticians, department stores and airport outlets won’t be neglected, there will be more accent on Kering’s directly-operated boutiques.

The Kering model is not something Safilo and Luxottica will want to see prosper, especially Safilo, which is far more reliant on its licence deals, but Vedovotto insists that the market is big enough to allow for happy commercial co-habitation. Nor does he see other groups and brands rushing to follow the Kering Eyewear example. ‘The business model we have decided to go for is not for everyone. There are only a few groups that can potentially afford an initiative like this.’

Kering Eyewear is not the only revolutionary in the market though. Warby Parker, for example, has developed from a cult online brand to a serious player that’s now opening its own stores. Vedovotto feels he shares a kinship with Warby Parker in terms of a startup’s flexibility and derring-do. And, ultimately, he believes this is what will get them through. ‘All the people here have the entrepreneurial spirit that is key to this initiative,’ he says. ‘This is the most difficult thing that any of us has done in our lives. But that’s the interesting part. It’s a challenge and a huge opportunity.’

As originally featured in the September 2016 issue of Wallpaper* (W*210)

Roberto Vedovotto, CEO of Kering Eyewear

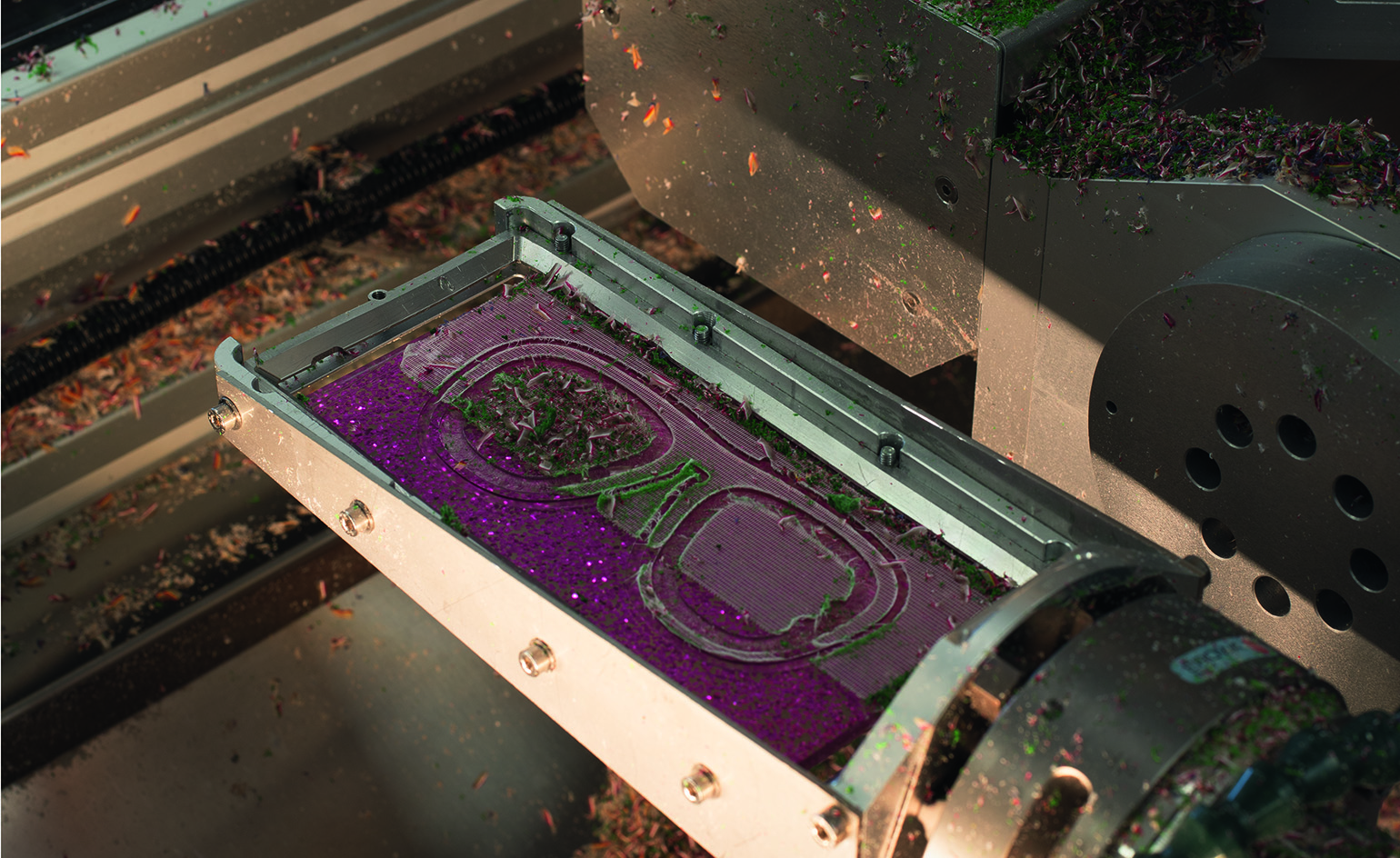

Left: prototype Brioni aviators in development. Right: Massimo Zuccarelli of Kering Eyewear and Vincenzo Castaldo of Pomellato

Villa Zaguri, Kering HQ

Left: Christopher Kane in his East London studio. Right: frames from his first unisex eyewear line launched in partnership with Kering Eyewear

Bottega Veneta for Kering Eyewear

Christopher Kane for Kering Eyewear

Saint Laurent for Kering Eyewear

INFORMATION

For more information, visit the Kering Eyewear website

Photography: Albrecht Fuchs

Wallpaper* Newsletter

Receive our daily digest of inspiration, escapism and design stories from around the world direct to your inbox.

-

All-In is the Paris-based label making full-force fashion for main character dressing

All-In is the Paris-based label making full-force fashion for main character dressingPart of our monthly Uprising series, Wallpaper* meets Benjamin Barron and Bror August Vestbø of All-In, the LVMH Prize-nominated label which bases its collections on a riotous cast of characters – real and imagined

By Orla Brennan

-

Maserati joins forces with Giorgetti for a turbo-charged relationship

Maserati joins forces with Giorgetti for a turbo-charged relationshipAnnouncing their marriage during Milan Design Week, the brands unveiled a collection, a car and a long term commitment

By Hugo Macdonald

-

Through an innovative new training program, Poltrona Frau aims to safeguard Italian craft

Through an innovative new training program, Poltrona Frau aims to safeguard Italian craftThe heritage furniture manufacturer is training a new generation of leather artisans

By Cristina Kiran Piotti

-

Unboxing beauty products from 2024, as seen on the pages of Wallpaper*

Unboxing beauty products from 2024, as seen on the pages of Wallpaper*Wallpaper's 2024 beauty picks included Chanel lipstick, Bottega Veneta perfume and solid soap from the likes of Aesop, Celine, Diptyque, Hermès and Sisley

By Hannah Tindle

-

The Wallpaper* style team pick their fashion moments of 2024

The Wallpaper* style team pick their fashion moments of 2024The Wallpaper* style editors reflect on their best fashion moments of 2024, from Rick Owens’ 200-strong Hollywood epic to an Eyes Wide Shut-inspired JW Anderson show, and a slicked-back beauty look at Saint Laurent

By Jack Moss

-

Giant cats, Madonna wigs, pints of Guinness: seven objects that tell the story of fashion in 2024

Giant cats, Madonna wigs, pints of Guinness: seven objects that tell the story of fashion in 2024These objects tell an unconventional story of style in 2024, a year when the ephemera that populated designers’ universes was as intriguing as the collections themselves

By Jack Moss

-

How 2024 brought beauty and fashion closer than ever before

How 2024 brought beauty and fashion closer than ever before2024 was a year when beauty and fashion got closer than ever before, with runway moments, collaborations and key launches setting the scene for 2025 and beyond

By Mahoro Seward

-

Loafer bags to sock shoes, 2024 was all about the mashed-up accessory

Loafer bags to sock shoes, 2024 was all about the mashed-up accessoryWallpaper* fashion features editor Jack Moss reflects on the rise of the surreal hybrid accessory in 2024, a trend which reflects the disorientating nature of contemporary living – where nothing is quite what it seems

By Jack Moss

-

The wait is over: Matthieu Blazy is Chanel’s new creative director

The wait is over: Matthieu Blazy is Chanel’s new creative directorMatthieu Blazy has been appointed as the new artistic director at Chanel, after a critically lauded and commercially successful tenure as creative director of Bottega Veneta

By Jack Moss

-

Bottega Veneta drafts Venetian artisans for its unique ‘Bottega for Bottegas’ project, a gift list of local craft

Bottega Veneta drafts Venetian artisans for its unique ‘Bottega for Bottegas’ project, a gift list of local craftItalian fashion house Bottega Veneta has sought out six craftspeople from in and around Venice to create precious objects – from playing cards to jigsaw puzzles – which arrive just in time for festive gift-giving

By Jack Moss

-

Fashionable Christmas baubles to accessorise this year’s tree, from Bottega Veneta to Loewe

Fashionable Christmas baubles to accessorise this year’s tree, from Bottega Veneta to LoeweSelected by the Wallpaper* style team, a gleaming array of Christmas baubles for fashion fans featuring fantastical designs from Bottega Veneta, Loewe, Prada and more

By Jack Moss