Aston Martin’s CEO, Adrian Hallmark, sets out the future of the luxury sports car brand

Wallpaper* sits down with Adrian Hallmark, the newly installed CEO of Aston Martin, to find out how the company will evolve over what promises to be an eventful decade of automotive change

It’s been four months since Adrian Hallmark took the reins at Aston Martin. The company’s new CEO followed on from the scarcely seen Amedeo Felisa, the former Ferrari CEO whose two-year stint was widely seen as a safe and steady holding pattern after the light bruising inflicted by the tenure of ex-AMG man Tobias Moers.

Adrian Hallmark, CEO of Aston Martin, at the company's HQ in Gaydon, Warwickshire

Hallmark’s pedigree is second to none. As CEO of Bentley Motors from 2018 to 2024, and with experience at JLR and Porsche before that, Hallmark has been at the helm of luxury manufacturers as they traverse the choppy seas of changing legislation, geopolitical unrest and a wholescale overhaul of the premium auto market.

Aston Martin Vanquish, launched in 2024

What does Hallmark have planned for this 112-year-old company? A famously strong brand with equally famous weak profits, Aston Martin’s frequently parlous finances have rarely dented the appeal or ability of its products. Hot on the heels of a tumultuous but ultimately successful launch timetable that saw four new products in just 18 months, Aston Martin’s current portfolio is as strong as it has ever been.

The 2025 Aston Martin Vantage Roadster alongside the Aston Martin Vantage

Hallmark sat down with Wallpaper* and a number of other key industry publications to discuss his plans and thoughts for the years to come. Admitting that one of the allures of the job was to be ‘the first guy to make Aston Martin sustainably profitable in 112 years’, Hallmark’s first point is to set out the new global context. ‘We’ve got the playbook,’ he says, ‘but the market has totally changed.’

Around the world, there’s more wealth than ever before. ‘There are four times as many people each with four times as much wealth as there was 20 years ago,’ Hallmark says simply, ‘the market for luxury has exponentially increased.’

Aston Martin DBX707

To capture a slice of this pie, Aston Martin, like its peers, must go even further upmarket. Thanks to the resources of Canadian billionaire Lawrence Stroll, Aston has spent lavishly, from a Formula 1 team to the immensely complex and costly development of the Valkyrie hypercar, not to mention the punishing development costs of the current range, Vantage, DB12, Vanquish and DBX, alongside recent specials such as the Valkyrie, Valiant, and forthcoming Valhalla - a figure of £2bn has been suggested.

Aston Martin Valhalla

How then, can the rich be encouraged to spend even more on an automobile they don’t really need in the first place? This end of the marketplace is about desire and novelty, the two intertwined to the point of inseparability. Noting that the typical ‘luxury ownership cycle’ for a car like an Aston Martin is around 2 years, Hallmark believes in giving customers somewhere to go next.

Wallpaper* Newsletter

Receive our daily digest of inspiration, escapism and design stories from around the world direct to your inbox.

As he points out, unlike competitors like Porsche, potentially loyal Aston Martin owners in search of a new fix have nowhere to go, given the relative paucity of existing variants. You either have a Vantage, or a Vantage Roadster.

Aston Martin Vantage

More variants are coming, with the factory also focusing on profitable things like optional extras and bespoke details. This was Hallmark’s great innovation at Bentley, where the Mulliner division (aped by the Q by Aston Martin service) can transform a ‘base model’ Continental into so much more for relatively little extra outlay by the factory.

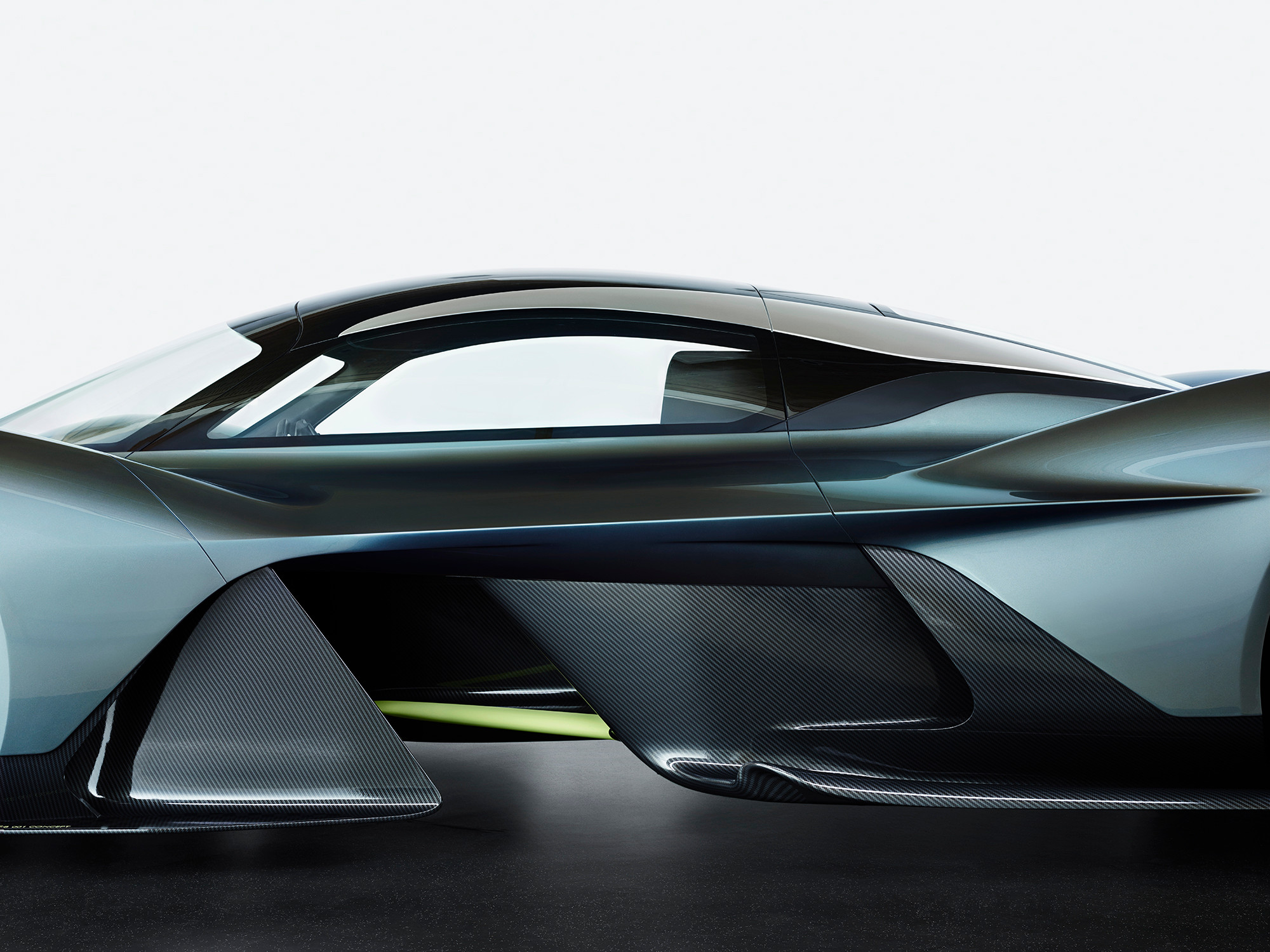

An early iteration of the Aston Martin Valkyrie, photographed by Benedict Redgrove

One early exercise Hallmark undertook was to explore every single optional extra offered by rivals but not by Aston Martin, from audio upgrades to things like Rolls-Royce’s ‘Starlight Headliner’. They found 190, and Hallmark believes that ‘at least 100 of them would suit a high-end brand like ours’ (not the Rolls-Royce headliner, for example).

Aston Martin Valkyrie, photographed by Benedict Redgrove

This is all very well, but there’s another even stronger current of uncertainty flowing through the auto industry; the EV transition. Hallmark, like his industry peers, is unstinting in his belief and commitment in an EV-focused future. However, that’s not how contemporary politics works. The oscillation in the cut-off date for ICE cars is very much at variance with the industry’s established technology development cycles. ‘It’s all in the air again, or is it?', he asks rhetorically, adding authoritatively that 'the general trend is absolutely towards electrification.’

The recent Aston Martin DB12 Goldfinger Edition

For a brand like Aston Martin, small and nimble though it may be, big technological commitments are a roll of the dice it can ill afford to lose. ‘We can’t afford to do EVs, hybrids and ICE cars and see which one works,’ Hallmark says. Flexibility is therefore the watchword. Hybrids will be the bridge, with the first volume model coming before the decade is out. He estimates that hybrid models will remain on sale until around 2035, depending on the market.

Ultimately, Hallmark’s own belief, informed by decades of experience, is that 2035-2040 will be when the full switch over point happens, at least in the UK. ‘We’re fully committed to BEVs,’ he says, ‘but uncertainty in the UK, US and EU is disruptive and we’ve got to protect the company.’

Aston Martin DB12 Volante

Industry-watchers will also be aware of rumblings amongst the luxury sports car customer base, who don’t seem to ‘get’ electric and favour the sound and feel of traditional, large-capacity engines. Before he left Bentley, Hallmark will have no doubt signed off many facets of the company’s as yet unreleased and unseen debut EV. It’s given him plenty of insight into the customer response.

‘There are two different customers,’ he says frankly, ‘ones that hate BEVs because they feel like they’re being to told to have one – the world ‘no’ really triggers billionaires. But there’s also a pro-EV group, which is growing.’ Noting that like all car companies, ‘we’ve got to be 7-10 years ahead of the consumer,’ he believes the market will ultimately come around.

The interior of the Valhalla, which will be Aston Martin's first PHEV

Valhalla will be Aston Martin’s first plug-in hybrid, although with an estimated starting price of £850,000, it’s no Prius. The PHEV generation will continue to source engines from Mercedes-AMG, while the hybrid battery and gearbox will come from elsewhere. Thus far, only Rolls-Royce has ventured into the world of pure EVs with the Spectre. ‘Of course we want them to succeed,’ Hallmark says, ‘because it proves there’s a market.’

Inside the Vantage: a huge amount of attention has recently been spent on AM's interiors

When it comes to the Aston EV, the current partner is America’s Lucid. ‘They have the best projected level of motors and battery systems at our level,’ Hallmark says, stressing that the car will absolutely not be a re-badged Lucid Gravity. Advances in materials and production technology will be core to the electric Aston feeling. ‘It’s very difficult to get that dynamic feel in a BEV,’ says Hallmark, ‘mass is the enemy.’

With a battery weighing in at around 7-800kg compared to the 150kg of a petrol engine, automotive engineers are looking at every possible way to save weight. These include 3D printed components and castings, new battery chemistry and other yet to be revealed innovations.

Aston Martin Vantage

Regardless of the powertrain, Hallmark is adamant that ‘volume is less interesting to us than value creation’. He points to Ferrari’s apparently effortless ability to make money on just 7,000 sales a year, and how things like ‘marginal changes can increase margins’. These changes will be laser-focused on the standard production cars, rather than the specials which tend to command at least seven figures.

Aston Martin has form in this area, much more so than Bentley, where Hallmark oversaw the introduction of the Continuation series Blowers, and the Continental-based Bacalar and Batur. In all, this accounted for around 120 cars; in comparison, Aston has just finished building around 300 Valkyrie variants, with Valiant ongoing and 999 Valhallas to follow.

Aston Martin Valiant

The key to selling such exotica are the collectors, the billionaire class of completists who simply have to have one, or more, of everything. Twenty years ago, such people barely existed. Even so, operating and succeeding in this absolute top tier of car design and manufacturing requires huge resources. The Valkyrie is a remarkable thing, but it was late, very demanding to build and arguably somewhat underpriced as a result, even at £2.5m.

Will they do another? ‘Not many car companies can afford, financially and emotionally, to do a car that’s so far ahead of what they normally do every single year. It’s a 7-10 year cycle,’ Hallmark says. ‘Everything on Valkryie is so unique.’ He lets on that the cars are still being refined even now they’re on the road, with over 90 engineering fixes already identified.

Aston Martin Valkyrie

In relatively stark contrast, Aston’s production series have much more in common with ‘regular’ cars: they’re bought in dealerships, often on finance. In comparison, 'specials' buyers want involvement and engagement in the process, the feeling that for a few months at least, Aston Martin is their car company, with a factory at their beck and call.

The Aston Martin DB5 Goldfinger continuation cars

Aston Martin has an asset in the shape of Aston Martin Works, the Newport Pagnell workshop that restores, services and updates the company’s many, many classics. In the past, Works has also helped assemble a series of Continuation cars, but it seems Hallmark now wants to look forwards, rather than back. ‘I was always jealous of AM Works when I was at Bentley,’ he says, ‘because we didn’t have a credible alternative – it’s why we did the Blowers so we could build the expertise and supply chain. But I think constantly doing recreations is not a good thing.’

A render of the upper floors of the Aston Martin Residences in Miami

When it comes to brand extensions, Hallmark says he’s changed his mind somewhat, again informed by his Bentley experience. ‘What I call tribal merchandise – hats, bags, t-shirts, etc. – has no real value,’ he says, ‘however, real estate and design is fascinating. Customers are much more open to brands moving into the design space.’ Bentley Home, with its bespoke furniture, global showrooms and dedicated hotel suites proved a huge success. ‘Brands are social badges,’ he continues, ‘I would argue that high design objects are the next specials.’

Aston Martin Brough Superior AMB001

Over the years, there’s been a number of Aston Martin-branded and designed real estate projects, from a private townhouse in Tokyo to a recently completed residential tower in Miami, to a house in New York state and apartments in Manhattan. Throw in a motorbike with Brough Superior, a helicopter with Airbus and hypothetical designs for yachts, eVTOL aircraft and more, and there’s experience and scope to expand.

Aston Martin Volante Vision Concept, 2018

China is another area of focus. The country's car market has seen a 35% drop in luxury goods sales in recent years, a knock-on effect on the country’s real estate crash. ‘The good news is that we’re not very successful in China,’ Hallmark says half-seriously, ‘performance brands don’t do as well as luxury brands and so we’re not as exposed as many of our competitors.’

That said, AM would like the chance to expose itself a little more. The DBX SUV should have spearheaded the assault on the Chinese market, but to date it has underperformed. A six-cylinder China-only model has been canned, and the existing car will be getting more upgrades that really drive home its capabilities. Effectively launched as Covid kicked in, Hallmark believes DBX was undermarketed as a result. Now reduced to a single model, the raucous DBX707, it remains an essential part of the business plan. ‘We can’t exist without an SUV,’ he says.

Aston Martin DBX707

Change can be a notoriously difficult thing to effect in the auto industry, but for Hallmark, steeped in the multi-layered hierarchy of the VW Group (owners of Bentley), coming to Aston Martin has been a breath of fresh air. ‘It’s brilliant – you think, and then you act,’ he says.

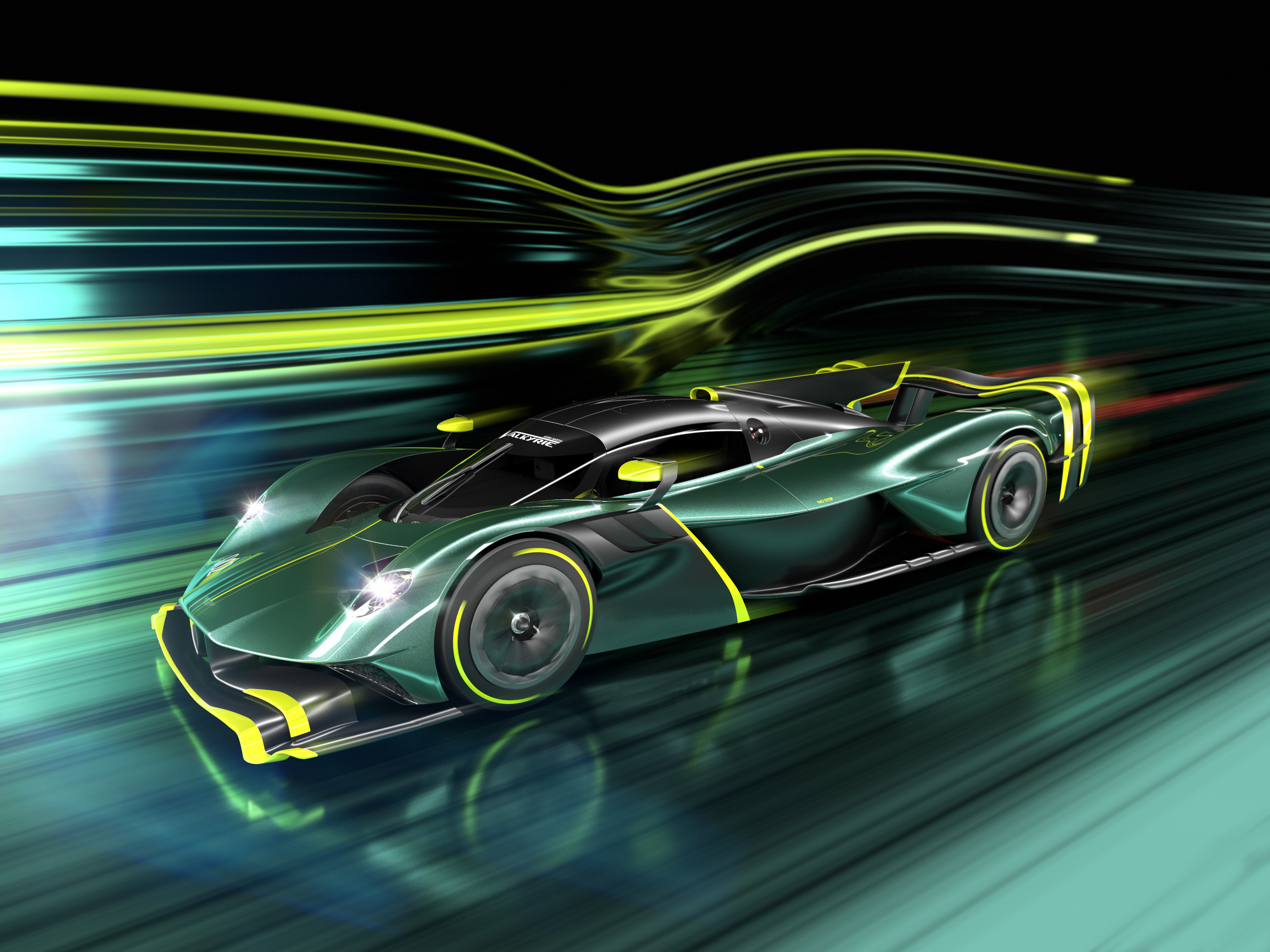

A render of the Aston Martin Valkyrie AMR Pro, an evolution of which will run at Le Mans in 2025

This agility, and Stroll’s reputation as a go-getter (if the price and prize is right) will underpin a couple of other notable forthcoming highlights, including Aston’s return to the top class at Le Mans this June with the Valkyrie. A podium finish would be a fairytale start to Hallmark’s era at Aston Martin, but regardless of the result, he firmly believes the company is well placed to deliver across the board.

Adrian Hallmark, CEO of Aston Martin, alongside the forthcoming mid-engined Valhalla

AstonMartin.com, @AstonMartin, @AstonMartinF1, @AstonMartinRacingOfficial

Jonathan Bell has written for Wallpaper* magazine since 1999, covering everything from architecture and transport design to books, tech and graphic design. He is now the magazine’s Transport and Technology Editor. Jonathan has written and edited 15 books, including Concept Car Design, 21st Century House, and The New Modern House. He is also the host of Wallpaper’s first podcast.

-

Tokyo design studio We+ transforms microalgae into colours

Tokyo design studio We+ transforms microalgae into coloursCould microalgae be the sustainable pigment of the future? A Japanese research project investigates

By Danielle Demetriou

-

What to see at London Craft Week 2025

What to see at London Craft Week 2025With London Craft Week just around the corner, Wallpaper* rounds up the must-see moments from this year’s programme

By Francesca Perry

-

The Audemars Piguet Royal Oak Perpetual Calendar watch solves an age-old watchmaking problem

The Audemars Piguet Royal Oak Perpetual Calendar watch solves an age-old watchmaking problemThis new watch may be highly technical, but it is refreshingly usable

By James Gurney